Applying for a Pell Grant online is an important step for students. The Pell Grant is a type of financial aid from the U.S. government. It helps undergraduate students pay for college. You must not have a bachelor’s, graduate, or professional degree to get it.

This guide explains How to Apply for Pell Grant Online. It also covers who can get it, what documents you need, and tips to improve your chances.

What Is a Pell Grant?

A Pell Grant is a type of federal aid. You do not have to pay it back. It helps low-income students pay for college.

The amount you get depends on your financial need, the cost of school, and your enrollment status. You apply for a Pell Grant through the FAFSA form.

Step-by-Step Guide to Applying for a Pell Grant Online

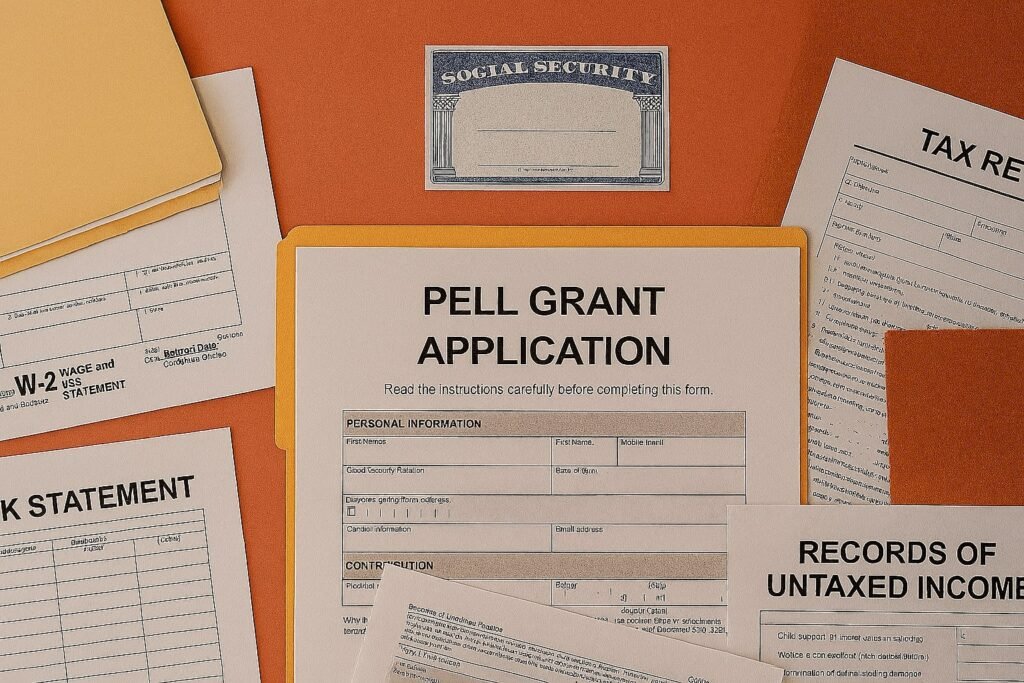

Step 1: Gather Required Documents

Before starting your application, ensure you have the following documents:

- Social Security Number (SSN): Required for identity verification.

- Driver’s License Number: If applicable.

- W-2 Forms and Tax Returns: For the previous year.

- Records of Untaxed Income: Such as child support received.

- Current Bank Statements: Including checking and savings accounts.

- Investment Records: Information on investments and real estate.

- Parents’ Financial Information: If you are a dependent student.

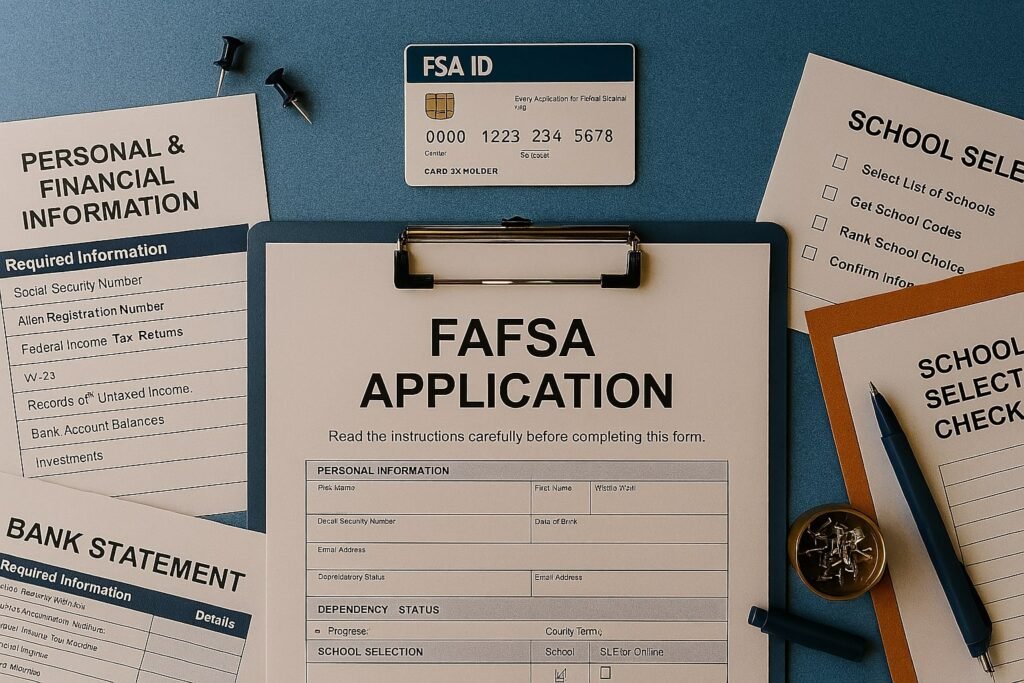

Step 2: Create an FSA ID

The Federal Student Aid (FSA) ID is a username and password combination that allows you to access and sign your FAFSA form electronically. Both students and parents (if applicable) need to create an FSA ID at studentaid.gov.

Step 3: Complete the FAFSA Form

Visit studentaid.gov to start your FAFSA application. Follow these steps:

- Log In: Use your FSA ID to log in.

- Select FAFSA Form: Choose the correct academic year.

- Provide Personal Information: Enter your SSN, name, and other personal details.

- Financial Information: Input your financial data and your parents’ information if you’re a dependent student.

- School Selection: Add the schools you’re interested in attending.

- Sign and Submit: Review your information, sign electronically, and submit the form.

Step 4: Review Your Student Aid Report (SAR)

After submitting your FAFSA, you’ll receive a Student Aid Report (SAR). Review it carefully for any errors or discrepancies. If corrections are needed, make them promptly to avoid delays in processing.

Step 5: Await Financial Aid Offers

Colleges and universities will use the information from your FAFSA to determine your eligibility for the Pell Grant and other financial aid. You will receive a financial aid offer from each school you applied to, outlining the types and amounts of aid you are eligible for.

Step 6: Accept Your Financial Aid Package

Once you receive your financial aid offers, review them carefully. Accept the Pell Grant and any other aid you’re eligible for. Follow the instructions provided by each school to accept or decline the offers.

Eligibility Criteria for the Pell Grant

To qualify for a Pell Grant, you must:

- Be a U.S. citizen or eligible non-citizen.

- Demonstrate financial need as determined by the FAFSA.

- Be enrolled or accepted for enrollment in an eligible degree or certificate program.

- Not have a bachelor’s, graduate, or professional degree.

- Maintain satisfactory academic progress in college or career school.

- Not be in default on a federal student loan or owe a refund on a federal grant.

Understanding the Student Aid Index (SAI)

The Student Aid Index (SAI) shows if you can get federal student aid. It includes the Pell Grant. The SAI replaces the old Expected Family Contribution (EFC).

A lower SAI means you have more financial need. This can help you get a bigger Pell Grant. The SAI is based on the information in your FAFSA form.

Disbursement of Pell Grant Funds

If you get a Pell Grant, the money goes straight to your school’s financial aid office. The school will use it for your tuition, fees, and other charges.

Any leftover money will be given to you. You usually get it in two payments during the school year.

| Topic | Details / Explanation |

|---|---|

| Pell Grant | A federal need-based grant for undergraduate students that does not require repayment. Amount depends on financial need, enrollment status, and cost of attendance. |

| Application Tool | FAFSA (Free Application for Federal Student Aid) – the main form to apply for Pell Grant. |

| Required Documents | – Social Security Number (SSN) – Driver’s License (if applicable) – W-2 forms & tax returns – Parents’ financial info (if dependent) – Bank statements, investment info, untaxed income records |

| FSA ID | Username/password needed to access and electronically sign FAFSA. Students and parents must create one at studentaid.gov. |

| FAFSA Process | 1. Log in with FSA ID 2. Provide personal info 3. Enter financial info 4. Add schools 5. Sign & submit form |

| Student Aid Report (SAR) | Summary of FAFSA info. Review carefully for errors. Corrections can be made online. Determines Student Aid Index (SAI). |

| Financial Need / SAI | SAI (formerly EFC) measures eligibility. Lower SAI → higher Pell Grant potential. |

| Eligibility Criteria | – U.S. citizen or eligible non-citizen – Financial need – Enrolled in eligible undergraduate program – No previous bachelor’s, graduate, or professional degree – Satisfactory academic progress – No defaulted federal loans |

| Colleges & Universities Role | Evaluate FAFSA info, determine eligibility, notify students, and disburse funds to student accounts. |

| Disbursement | Pell Grant funds are applied to tuition, fees, and other charges. Remaining amount is usually paid to students in two installments per academic year. |

| Common Tips | – Submit FAFSA early (after October 1) – Keep documents ready – Ensure accuracy – Know your dependency status – Respond promptly to SAR corrections |

| FAQ Highlights | – Can current students apply? Yes – Annual application required? Yes – Can I receive alongside scholarships? Yes, within cost limits – Mistakes on FAFSA? Correct online – How to know if eligible? Financial aid offer from schools |

Frequently Asked Questions (FAQs)

1. Can I apply for a Pell Grant if I’m already in college?

Yes, as long as you meet the eligibility criteria and have not yet earned a bachelor’s, graduate, or professional degree.

2. How often do I need to apply for the Pell Grant?

You must submit a new FAFSA form each academic year to be considered for the Pell Grant.

3. Can I receive the Pell Grant if I have other scholarships?

Yes, but your total financial aid package cannot exceed your school’s cost of attendance.

4. What if I make a mistake on my FAFSA?

You can correct your FAFSA by logging into your account and making the necessary changes.

5. How will I know if I qualify for the Pell Grant?

Conclusion

Applying for a Pell Grant online is easy. It can help lower the cost of college. Follow the steps in this guide. Gather all the needed documents. Know the eligibility rules to improve your chances.

Submit your FAFSA early. Check your Student Aid Report for mistakes. Keep up with any changes in the application process.

Author Bio:

John Doe is a financial aid advisor with over 10 years of experience assisting students in navigating the complexities of federal financial aid. He specializes in Pell Grants, scholarships, and the FAFSA process.

References: