Financial aid eligibility means if a student can get help to pay for college in the United States. This help may come from the federal government, states, colleges, or private lenders. A student’s eligibility depends on things like status, grades, and money needs.

This guide shows you step by step what FAFSA is, who counts as an eligible non-citizen, how school aid works, and when private student loans may help. In this way, you can see the choices open to you.

What Is Financial Aid Eligibility?

Financial aid eligibility is the set of rules that decides who can get money for college in the U.S. This money can come from federal programs, state programs, or college scholarships.

You usually need to meet a few things to qualify:

- Be a U.S. citizen or have an eligible immigration status.

- Show financial need (family income and savings).

- Make academic progress (pass your courses).

- Be enrolled in a recognized college or university.

The first step is to fill out the FAFSA (Free Application for Federal Student Aid). It tells you how much aid you can get and from which sources.

FAFSA: The Core of Financial Aid

FAFSA is the official form to apply for federal, state, and college aid.

- It calculates your Expected Family Contribution (EFC) or Student Aid Index (SAI).

- It’s required for Pell Grants, federal loans, and work-study programs.

- Many states and colleges also use FAFSA to award their own aid.

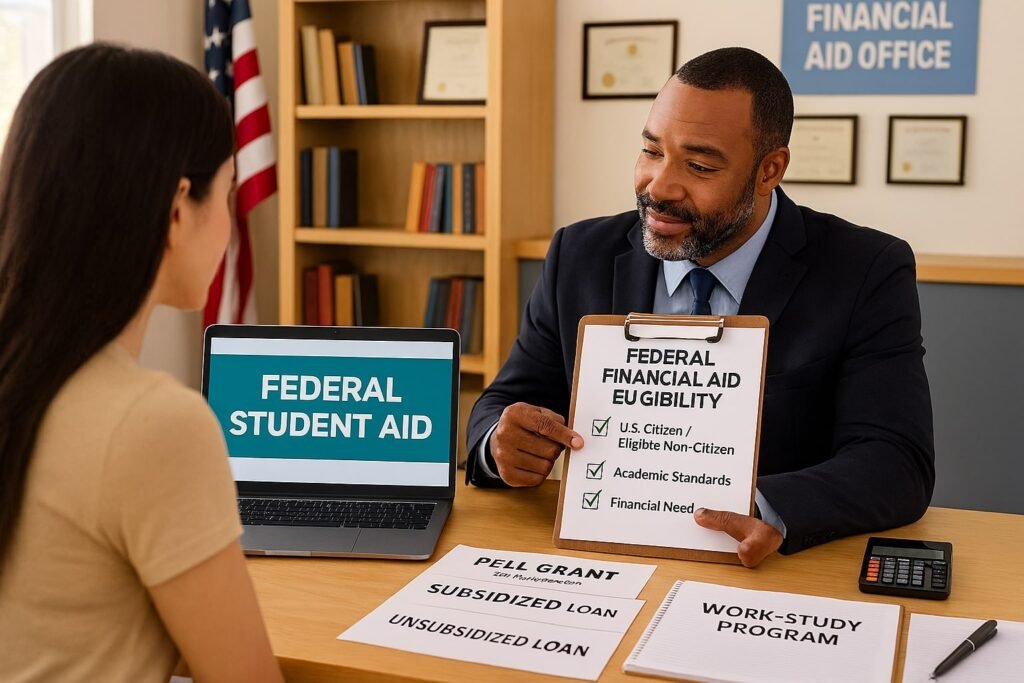

Federal Financial Aid Eligibility

To get federal financial aid, you must be a U.S. citizen or an eligible non-citizen. You also need to meet academic and financial rules.

Types of federal aid include:

- Pell Grants. These are need-based and do not need to be paid back.

- Direct Subsidized and Unsubsidized Loans.

- Federal Work-Study programs.

Federal aid is the main source of student funding, but not everyone can get it.

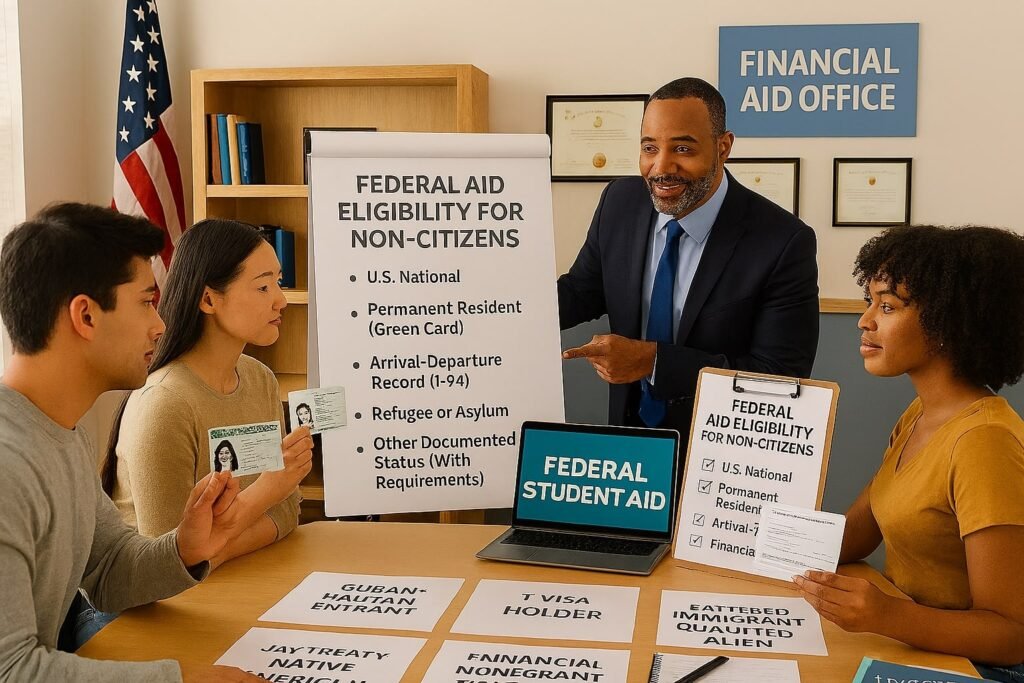

Eligible Non-Citizens: Who Qualifies?

Some non-citizens can still get federal aid if they meet certain immigration rules.

You may qualify if you are:

- A U.S. permanent resident (Green Card holder)

- A refugee or someone granted asylum

- A Cuban-Haitian entrant

- A T visa holder or a child of a parent with T1 status

- A battered immigrant qualified alien

- A U.S. national, like someone born in American Samoa

- Certain Native Americans born in Canada under the Jay Treaty

The I-94 Form (Arrival-Departure Record) is usually used to prove your immigration status.

Citizens of the Federated States of Micronesia, Marshall Islands, or Palau may have limited aid.

Institutional Aid (College-Based Aid)

Even if you don’t qualify for federal aid, colleges can offer their own scholarships, grants, or loans.

- Merit-based scholarships for strong academics or athletics

- Need-based institutional grants

- Special scholarships for international students

Colleges have full control over this type of aid. Always ask the financial aid office about options.

Private Student Loans (When Federal Aid Isn’t Enough)

Private student loans are offered by banks or lenders and often require a co-signer, especially for international students.

- Interest rates may be higher than federal loans.

- Terms depend on credit history of borrower and co-signer.

- Best as a last resort when grants and federal loans are not enough.

Real-Life Example (Experience)

Sara, a student from El Salvador, came to the U.S. with her family. She applied for asylum and got refugee status. Using her I-94 Form, she showed she was an eligible non-citizen. FAFSA confirmed her status, and she got a Pell Grant and subsidized loans.

Ahmed, an international student from Bangladesh, did not qualify for federal aid. He received institutional aid from his university. Later, he took a private loan with a co-signer.

What I Like (Strengths of the System)

- Clear process through FAFSA

- Multiple types of aid (grants, loans, work-study)

- Support for eligible non-citizens

- Options even for students without federal eligibility (institutional aid, private loans)

Areas for Improvement

- Complex eligibility rules (confusing for international students)

- Restrictions for students in default or with certain convictions

- Limited aid for Micronesia, Palau, and Marshall Islands citizens

- Heavy reliance on co-signers for private loans

Comparison Table: Types of Financial Aid

| Type of Aid | Who Qualifies | Repayment Required | Example Programs |

|---|---|---|---|

| Federal Financial Aid | U.S. citizens & eligible non-citizens | Some (loans) | Pell Grant, Direct Loans, Work-Study |

| State Aid | Residents of the state | Depends | Cal Grant (California), TAP (NY) |

| Institutional Aid | Depends on college policy | Usually No | Merit scholarships, need-based grants |

| Private Student Loans | Anyone with a co-signer & credit check | Yes | Sallie Mae, Discover Student Loans |

FAQ: What Students Ask About Financial Aid Eligibility

1. What is financial aid eligibility in simple words?

It means whether you can get money from the government, states, or colleges to pay for school.

2. Do international students qualify for FAFSA?

No, unless they are eligible non-citizens. Most internationals rely on institutional aid or private loans.

3. What documents prove eligibility?

U.S. passport, Green Card, or I-94 Form for non-citizens.

4. Can I get aid if I’m not making good grades?

You must meet Satisfactory Academic Progress (SAP). Failing courses may cause aid loss.

5. Can someone with a drug conviction get aid?

It depends. Some restrictions apply, but completing rehab programs may restore eligibility.

6. Do I need a Social Security Number for FAFSA?

Yes, except for certain eligible non-citizens with alternative documentation.

7. Can I apply for both institutional aid and federal aid?

Yes. Most students combine multiple sources of aid.

Conclusion

Financial aid eligibility decides whether you can receive help paying for college in the U.S. The process starts with FAFSA, which covers federal financial aid. If you’re a U.S. citizen or an eligible non-citizen (Green Card holder, refugee, asylum status, etc.), you likely qualify. If not, you may still find institutional aid or private student loans.

Author Bio:

John Smith is a seasoned financial aid advisor with over 15 years of experience assisting students in navigating the complexities of U.S. financial aid systems. He holds a Master’s degree in Higher Education Administration and has worked with numerous institutions to develop accessible financial aid programs. John is committed to empowering students with the knowledge to make informed decisions about funding their education.

References

- U.S. Department of Education – Federal Student Aid

- Federal Student Aid Handbook – Eligibility Rules

- National Association of Student Financial Aid Administrators (NASFAA)